What is the Value Adjustment Board?

The Value Adjustment Board is composed of two members of the County Commission, one member of the School Board, and two taxpayers. It exists to determine whether or not your property is appraised in excess of its “just valuation” as of January 1 of the current year. At this informal conference, you present the facts you consider to support your claim for a change in the assessment, and the Property Appraiser’s office presents the facts we consider to support the correctness of the assessment.

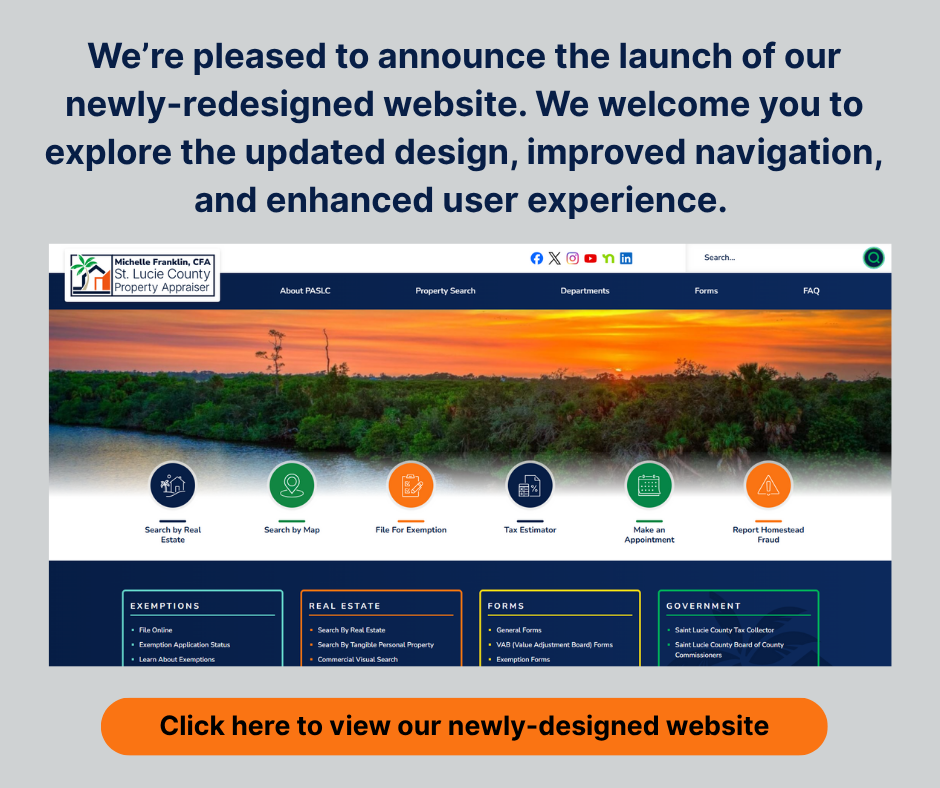

About PASLC

About PASLC Property Search

Property Search Exemptions

Exemptions Tangible Personal Property (TPP)

Tangible Personal Property (TPP) Public Records Request

Public Records Request FAQ's

FAQ's Recording A New Deed

Recording A New Deed Contact

Contact